FOMC Preview: Dovish Hike, Symmetric Risks

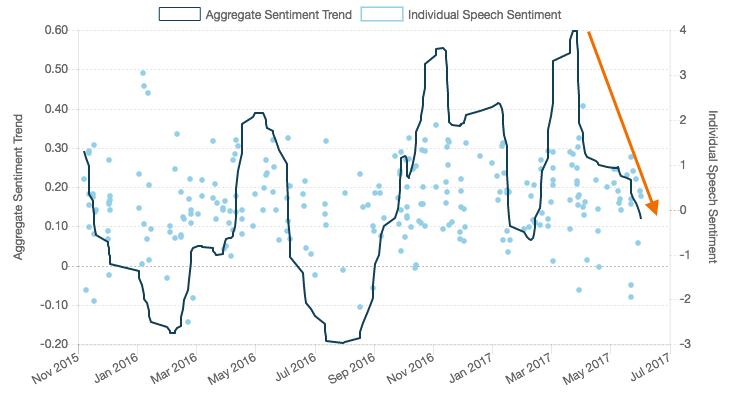

The market is implying a tepid pace of tightening after June, with half a hike priced in for the rest of the year and one more for all of 2018. This is consistent with Fed speech sentiment, which has reverted to a neutral stance after the rapid hawkish shift ahead of the March hike. Since the May meeting, labor market indicators have softened and the USD has weakened accordingly. As a result, the base case scenario calls for a rate hike accompanied by a dovish shift in language.

Statement Language

Key words: transitory, balanced, reinvest

The language in the introductory paragraph will likely be modified to acknowledge the recent softer data, but this should be widely expected. They may also revise their reinvestment guidance (currently: “until the normalization of the federal funds rate is well under way”) to be more consistent with their recent communications (i.e. “later this year”).

Potential hawkish surprise: Announcing a start date to their quantitative tightening and specifying the cap schedule

Potential dovish surprise: A change in the balance of risks toward the downside, or an indication that the slower Q1 growth is not transitory after all

Dot Plot

More likely to be revised down than up, but consensus is for no change. Any revision lower would call into question even the modest hikes that are priced for the rest of this year and would be a dovish surprise.Policy Rate

The market has forced their hand here. The Fed is not likely to skip the opportunity to hike with 100% probability priced in. Needless to say, risk/reward favors being short that probability (long the June FF future), or having no position at all.