ECB Preview: Downside Risks to the Euro

- In our view, the risks over the June ECB are tilted toward short-term Euro weakness.

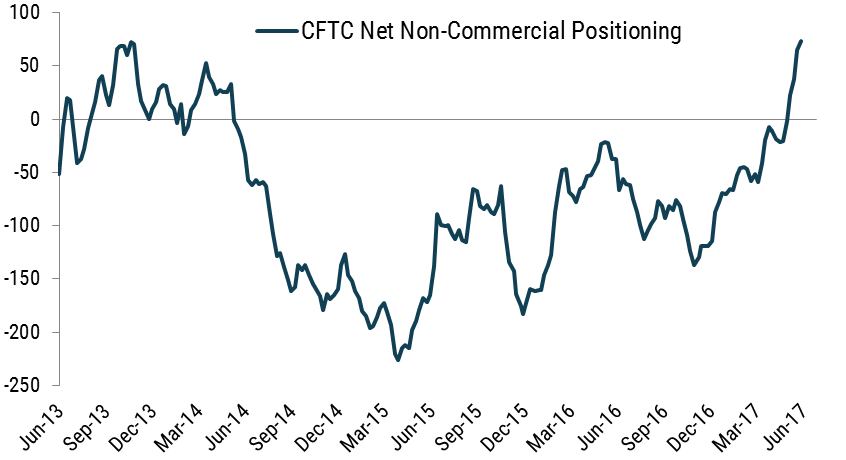

- First, speculative positioning recently turned net long and is now at its longest level since May 2014.

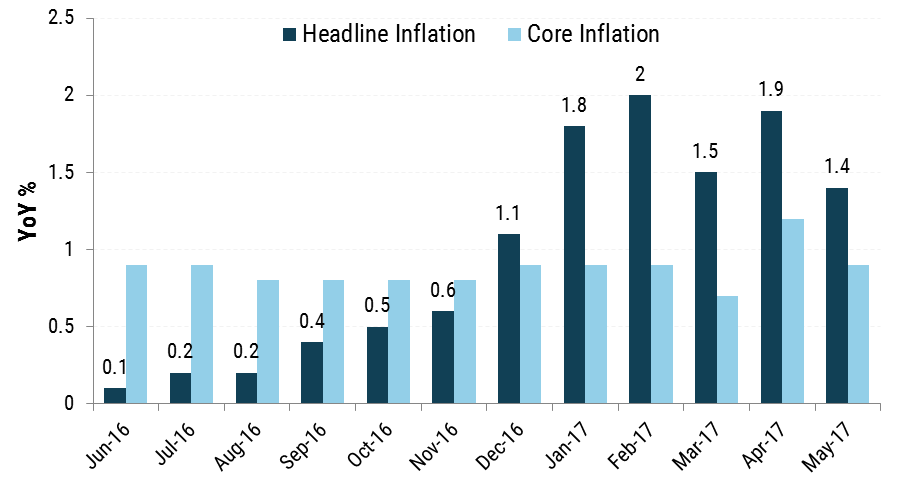

- Second, inflation data have come in slightly below expectations and inflation pressures remain subdued.

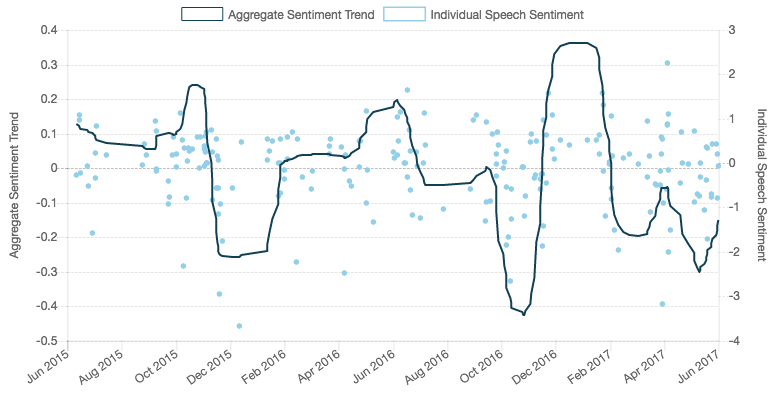

- Finally, ECB speaker sentiment remains tilted toward the dovish side.

We see at least three reasons for Euro bulls to be concerned going into this week’s ECB:

1. Speculative positioning is the longest it’s been since May 2014

EUR/USD has rallied about 3% since the last ECB meeting. Although this was mainly driven by a reduction in political risks following the French election, it also coincides with market participants expecting a more hawkish ECB. For the reasons outlined below, we think that those looking for a hawkish shift in language this week will be disappointed.

EUR/USD has rallied about 3% since the last ECB meeting. Although this was mainly driven by a reduction in political risks following the French election, it also coincides with market participants expecting a more hawkish ECB. For the reasons outlined below, we think that those looking for a hawkish shift in language this week will be disappointed. 2. Recent inflation readings have ticked lower since the April meeting

May’s headline inflation came in at 1.4%, the lowest reading of the year. Much of the recent gains in inflation have come from energy prices, but core inflation is still below the bank’s 2017 forecasts. These figures are not enough to change the balance of risks surrounding inflation. We would expect continued optimism about the growth outlook, but as Draghi reminded us during the last press conference, “easing biases are actually linked to inflation…the easing biases are meant to cope with tail risks concerning the inflation rate, not growth directly.”

May’s headline inflation came in at 1.4%, the lowest reading of the year. Much of the recent gains in inflation have come from energy prices, but core inflation is still below the bank’s 2017 forecasts. These figures are not enough to change the balance of risks surrounding inflation. We would expect continued optimism about the growth outlook, but as Draghi reminded us during the last press conference, “easing biases are actually linked to inflation…the easing biases are meant to cope with tail risks concerning the inflation rate, not growth directly.”3. ECB speaker sentiment remains tilted to the dovish side

Aggregate speaker sentiment reached peak dovishness ahead of last December’s QE adjustment. After a brief hawkish trend to start 2017, ECB speakers have recently continued to lean on the dovish side. This does not signal any urgency on their part to alter forward guidance.

Aggregate speaker sentiment reached peak dovishness ahead of last December’s QE adjustment. After a brief hawkish trend to start 2017, ECB speakers have recently continued to lean on the dovish side. This does not signal any urgency on their part to alter forward guidance.